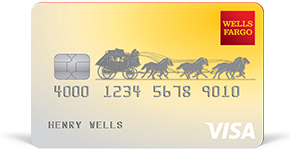

It is commonly recognized as plastic money which is used in place of the money. A credit card is used to purchase any creation from the market on recognition. It has 16 digits no and CVV no. and a single pin no. which has to be reserved secret by the user.

It has replaced currency explanation and has originated a permanent leave in our wallets, on the other hand, it is an uncertain mystery for many and thus resultant into hundreds of protest about overload fees, arraign since its inadequately understood even although banks offer users all the desirable in sequence in form of an in black and white provisions and situation that come with their certificate tackle of แจกคูปองฟรี .

The users frequently have an assorted evaluation about a credit card. Some users are very content with these while some are so motivated that they harshly deny having one in the potential. We are going to converse here about the same subject.

Commonly, a credit card comes with payback and some charges which are not hidden. Like special cards come with unusual annual fees, late expense charges, and another arraign. But when a person pertains for a card, They often view only the profit and not other rules and regulations. Somewhere, there is also the burden of the salesperson as he is not bright to properly show the purchaser. Which results in his unconstructive feedback. So, is there any resolution to this difficulty? Yes, of course, a little concentration should save us from superfluous charges. What we need to do at the present is read these imperative tips to follow to participate protected with credit cards.

We should know about important facts regarding cashback

- There is an outstanding date mentioned in the billing account. We need to pay our bill before this outstanding date to evade late fees. All banks have unusual late fees like Rs. 750 for a month.

- In the bill announcement, two amounts are stated namely the Minimum payable amount and Total Due amount. we should avoid interest on our next bill, be sure to compensate the total due amount instead of the lowest amount due amount. Paying the lowest amount due amount will acquire us low cibil attain and superfluous charges on our bill. These charges diverge with the collection and can be 3-4%

- All the cards have a permanent bill cycle and reimbursement date. So, don’t stop thinking about managing our fixed cost to compensate the bill on time.

- Always check our bill account. And if we think that it needs to be accurate, then do it within 60 days.

- Remember our credit card number forever. In case, it is missing then it is trouble-free for us to account it fast to the bank. Also, it can be trouble-free for shopping online because we will not have to receive it out always. on the other hand, at the time of shopping us also need CVV no. and finish date. But it’s good to consider our credit card no.

- Check the yearly charges and other amounts of the bank while being appropriate for a credit card. All the banks have special fees and allege which We need to check. This will help us in significant about our credit card and the forthcoming charges. So, that we could not be astounded with these fees and arraign.